Investing Where Few Dare: Lessons from Po Bronson on Deep Tech

“In deep tech, the only thing that flies is ‘we are doing something nobody else in the world can do and we will win.’” – Po Bronson, Managing Director at SOSV’s IndieBio

At HBAN’s recent Masterclass in Deep Tech Investing, hosted by Republic of Work, a HBAN regional lead in the all-island network, renowned investor and author Po Bronson shared his insights on what separates truly investible Deep Tech startups from the rest.

His message to angels and early-stage investors was direct: Deep Tech is not about chasing the latest hot sector. It’s about conviction, clarity, and the willingness to back founders who are pushing the boundaries of what’s possible.

The Discipline Behind Deep Tech Investing

Deep Tech startups are often defined by their scientific complexity and long development timelines. For investors, this means due diligence cannot stop at assessing whether the technology “works.” Instead, it requires understanding whether it can win — whether it can compete, scale, and create defensible value.

As Po Bronson put it, “Will it work? is not the same as Will it win?”

That distinction requires investors to look deeper than the science — to assess the commercial model, market dynamics, and barriers to competition.

Make Founders Do Their Homework

Bronson was equally clear about what separates strong founders from dreamers. “Make your founders do their homework,” he said. A serious competitor analysis should be detailed and data-driven — 10 to 20 pages of evidence, insights, and numbers that demonstrate real understanding of the market.

This level of rigour doesn’t just help investors make informed decisions; it forces founders to confront the realities of execution and competition before capital is committed.

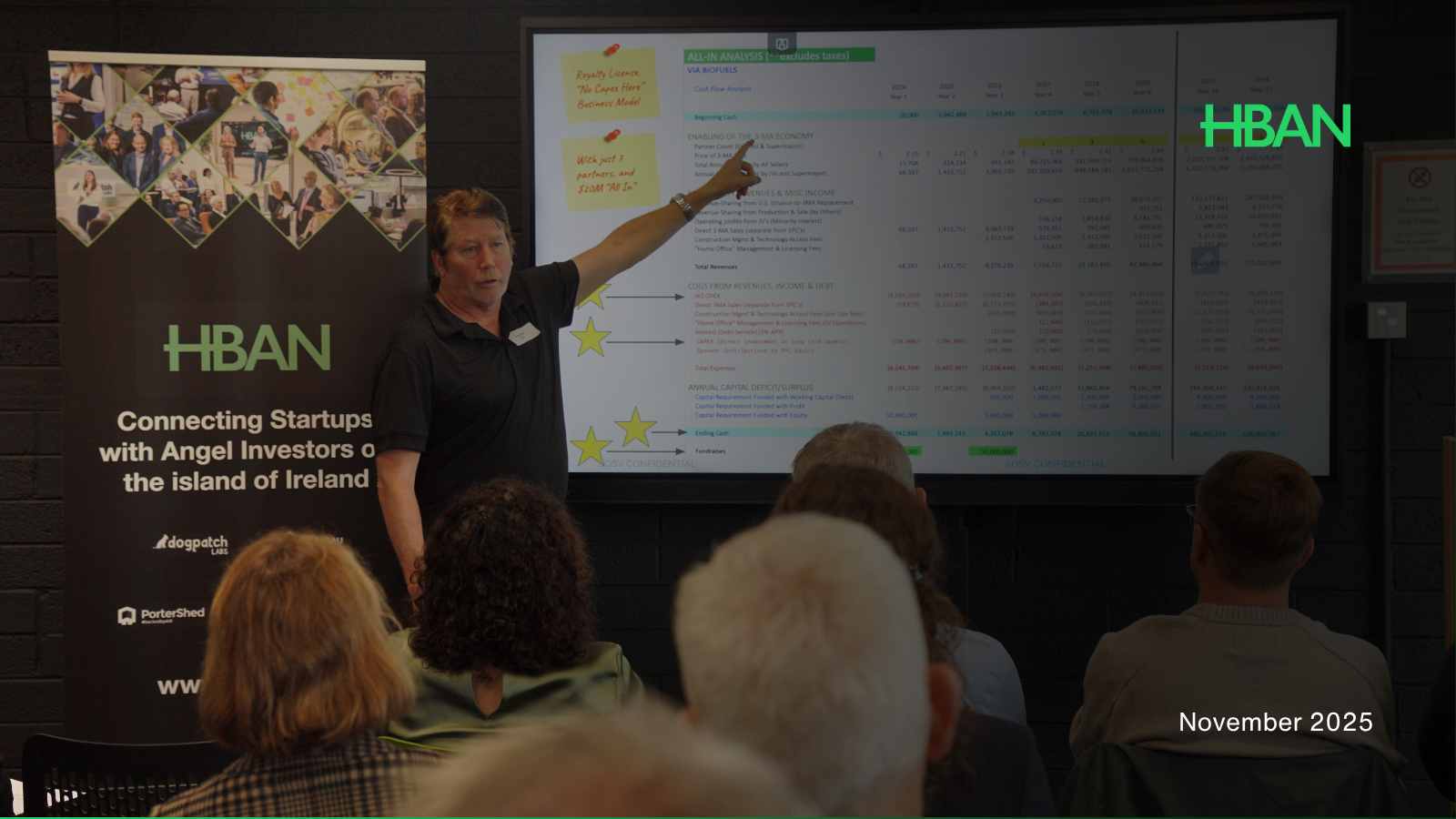

The Power of Cash Flow Discipline

Bronson emphasised that financial clarity is just as important in Deep Tech as in any other sector. “Do cash flow projections,” he urged — not just for startups, but for investors and corporate innovation teams too.

Understanding the cash dynamics of a business helps both sides avoid unrealistic expectations and maintain alignment through the long development cycles typical in Deep Tech.

Back the Brave

“Don’t look back wishing you did the homework and weren’t hesitating. You’ll learn from mistakes and know what was clear at the time,” Bronson said.

In Deep Tech, conviction matters. If a founder is willing to bet their life on a technology that only a handful of experts in the world truly understand, that deserves serious consideration. True innovation often starts as a lonely pursuit — the signal that something genuinely new is being created.

Navigating the Frontier

Deep Tech can appear daunting: complex science, uncertain timelines, and high risk. But as Bronson reminded the audience, “Nothing breaks the laws of physics — but the rules of biology are broken every day.”

For angel investors, that’s both a caution and an invitation. The breakthroughs that shape the next decade are already being built in labs and accelerators around the world. Understanding where to place early conviction — and where to walk away — is what defines great Deep Tech investing.

About the Event

The Masterclass in Deep Tech Investing with SOSV was part of HBAN’s ongoing commitment to supporting angel investors across Ireland and beyond. Hosted by Republic of Work, a HBAN regional lead, the event brought together investors, founders, and innovation leaders to explore how early-stage capital can accelerate world-changing science.

To learn more about HBAN’s investor network, regional events, and upcoming masterclasses, follow HBAN on LinkedIn